Binance Dual Investment Guide

What is Binance Dual Investment ?

By Crypto Nation – 03 July 2021

Binance Dual Investment (also called Dual Saving) is a financial product offered by Binance, you will find our guide on the platform in question by clicking here. This product allows you to deposit a cryptocurrency (eg USDT) and earn a return based on two assets (eg USDT or BTC). Dual Investment has a high return, but also risks. The annualized return is fixed, but the final payout will be influenced by the price of the asset upon delivery and the strike price. The crypto market is very volatile, and it is in this context that the risk of Dual Investment lies.

A high yield financial product

Contents of the Dual Investment review:

Subscribe to Binance Dual Investment

First of all, you need an account on the Binance platform. Click here to register and get a reduction in your transaction fees.

A dedicated guide to the Binance platform is available here.

Once your Binance account is open, go to the Finance tab > Binance Pool.

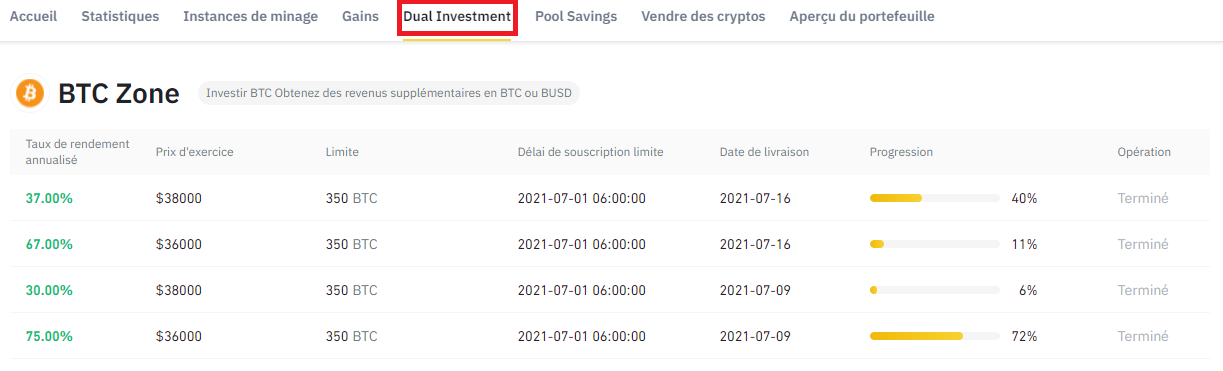

Finally, click on the Dual Investment tab , you will see a list of different products displayed, such as BTC, USDT and BUSD.

Each of these products has unique annualized rate of return, delivery date and strike price. When the subscribed product expires, the corresponding cryptocurrency will be added to your Binance Spot Wallet within 48 hours.

How this product works

“Dual” because by using this financial product, two scenarios are possible.

You can subscribe with stablecoins USDT and BUSD, or BTC.

The displayed rates of return (APY) are all annualized.

The subscription of the product is over a short period (30 to 60 days max) or even very short (7 to 15 days).

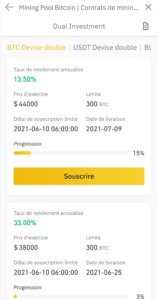

Details are directly on each of the proposed products, namely :

- Annualized rate of return: The fixed interest you will earn when the product is settled.

- Strike price: The price threshold that determines the cryptocurrency in which you will be paid. It is calculated on the BTC / USDT basis of the following 7 trading platforms: Bitstamp, Bittrex, Coinbase Pro, Gemini, Kraken, Bybit, LMAX Digital. The 2 extreme prices are removed and the retained price then becomes the average between that of the 5 remaining platforms.

- Limit: Maximum amount of the subscription.

- Subscription deadline: Closure of subscriptions.

- Delivery date: Date on which your cryptocurrencies will be reimbursed, with the interest you have earned.

These products are in limited quantity, the products with the most interesting rates being those which are found most quickly full.

Your subscriptions are visible on Binance in the Portfolio tab > Earn Cryptos, then in the “Double investment” tab.

A subscription made can not be canceled, it is necessary to wait until the end of the expiration date of the product, given in the details thereof.

The operation therefore takes place in 2 scenarios with 3 different liquidities (BTC / BUSD / USDT). We will give you some examples.

Example of subscription with USDT

Thomas decided to invest $100 in the Dual Investment.

The current price of BTC is $10,000.

He decides to subscribe to a double investment in USDT.

The product details are as follows :

- APY: 50% annual

- Duration: 15 days

- Exercise price: $12,000

When the subscription expires, two scenarios are possible :

- Scenario 1: The price of BTC is above the strike price (BTC> $12,000).

- Thomas receives the value of his USDT in USDT + interest.

- $100 + ($100 * 50%) * 15/365 = $102.06 USDT. The USDT return to his Spot wallet.

- Scenario 2: BTC price is below strike price (BTC < $12,000).

- Thomas receives the value of his USDT in BTC at the strike price + interest.

- $100 / $12,000 + ($100 / $12,000 * 0.5 * 15/365) = 0.0085045662 BTC. The BTCs return to his Spot wallet.

Example of subscription with BTC

Thomas decided to invest 1 BTC in the Dual Investment.

The current price of BTC is $10,000.

He decides to subscribe to the double investment product in BTC.

The product details are as follows :

- APY: 40% annual

- Duration: 30 days

- Exercise price: $15,000

When the subscription expires, two scenarios are possible:

- Scenario 1: The price of BTC is higher than the strike price of the product (BTC> $15,000).

- Thomas receives the value of his BTC in BUSD + interest.

- $15,000 * 40% * 30/365 + $15,000 = $15,493.15 BUSD. The BUSDs return to his Spot wallet.

- Scenario 2: BTC price is below strike price (BTC <$15,000).

- Thomas receives his initial BTC + interest.

- 1 + 1 * 40% * 30/365 = 1.0328767123 BTC. The BTCs return to his Spot wallet.

The risks of dual investment

Depending on the product execution scenario, the invested asset can be converted without another cryptocurrency upon delivery (BTC, USDT or BUSD).

Subscriptions cannot be canceled. There is therefore a risk due to the blocking of funds, during a possible period of high volatility in the crypto market.

Also keep in mind that the reference price mentioned in the product details may be readjusted according to the price on the Spot market, up to 24 hours after the start of the offer period.

Our conclusion on Dual Investment

This product is interesting because in fact, when delivering a subscription, you are never a loser. You always generate interest on the amount placed, in BTC or Stablecoins. It is then up to you to make the right decisions, following what has been delivered to you, to put yourself back in the crypto market effectively.

If you want to go further with the Binance environment, you can find additional information on our Binance and Binance Futures pages.